Smart Android And Trik-Commenting on Andorid indeed never endless, because smart devices this one is often updated every certain amount of time. So that the market can always be garapnya menerinya with pleasure. And it is not denied if this device has become the lifestyle of each society. To not wonder if the 6th business information and many are turning to mobail smartphone. With Android which thoroughly dominated the mobile industry, choosing the best Android smartphone is almost identical to choose the best smartphone, period. But while Android phones have few real opponents on other platforms, internal competition is intense.

T-Mobile has entered the banking business by launching its online banking product. It’s going after big banks in the US which charge monthly maintenance fees if you don’t keep a minimum balance. In addition, T-Mobile is offering certain customers a flexible way to deal with overdrafts. Let’s take a closer look at T-Mobile MONEY and who can benefit from it.

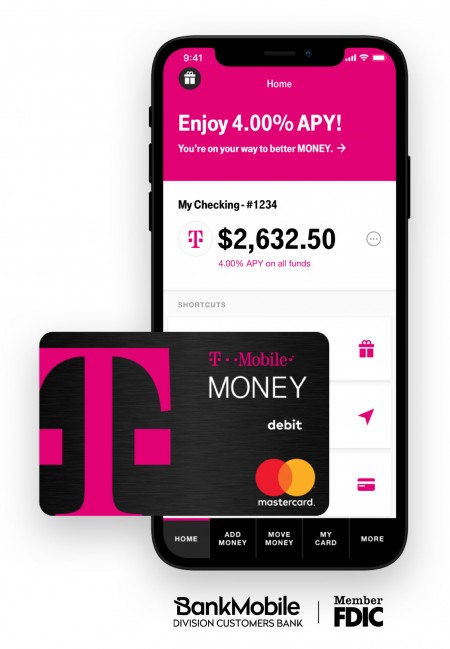

For starters, this is an online-only banking product which means all your banking will be done using the T-Mobile MONEY app. From here, you’ll be able to deposit checks, check your balance, transfer money, or make p2p payments. You’ll also get a Debit Mastercard for making purchases that is compatible with Apple, Google, and Samsung Pay wallets.

Compared to big bank names with physical locations, you won’t pay a monthly fee to maintain an account and there’s no minimum balance required.

Your balance does need to be above $0, though. But T-Mobile is solving a pain-point with many banks in the US – overdraft fees. If you make a purchase that surpasses your available balance, you won’t be charged an overdraft fee up to $50 into the red. T-Mobile will give you 30 days to get your account back into the black before issuing a charge. This is only available for T-Mobile postpaid customers and is an opt-in feature.

T-Mobile’s MONEY is backed by Bank Mobile, a division of

Finally, T-Mobile MONEY lets you earn a 4% APY for up to $3000 and 1% APY on anything above that. You can withdraw cash from a worldwide network of Allpoint ATMs and T-Mobile isn’t charging fees for using an out-of-network ATM. Of course, currency exchange and MasterCard fees for those ATMs may still apply.

You don’t actually have to be a T-Mobile customer to apply, all you need is to live in any of the 50 United States and have a social security number. You can sign up by downloading the app on iOS or Android or visit a physical T-Mobile store.

The only real downside to an electronic bank such as this one is that you can’t deposit cash to your account as easily. You’d have to get a cashier’s check and pay a fee if you really wanted to do that. But if you get paid by check or direct deposit, then it’s a no brainer.

Is T-Mobile MONEY something that interests you? Tell us about it in the comments!

0 Response to "T-Mobile announces free MONEY banking with no overdraft or ATM fees"

Post a Comment